In 2020, it was said there were $1,540 trillion of global assets in the world. To make life easy, let’s say all of these assets were extremely liquid and could be converted to cold, hard cash.

To spell it out, that is $1,540,000,000,000,000 of cold, hard cash.

As of today, there are roughly 8 billion breathing, living humans in the world. Now, let’s say that we decided as a human race to hit a hard reset on everyone’s life and each person got all of their wealth taken away from them. It was decided all of the cash would be distributed evenly. Each person would now get $192,500. Everyone would be rich! But how long do we think it would remain that way? How long would the wealth remain evenly distributed?

There is work that is required to both get rich and stay rich. The bust can be as big as the boom. There are lottery winners and generational wealth, but those are the only two ways to get rich that require little to no work. You wake up one morning considerably wealthier than when you laid your head to rest the night before having largely done nothing.

Most wealth-building is small, methodical steps that slowly build on each other and one day, boom, your life is changed. It is all about the saying, “It takes ten years to become an overnight success.” And of course, there is the exact same thing on the other side. There are small, reckless habits that can froth at the top before exploding and wrecking your finances. It can be the result of small commitments missed. Before you know it, the small things eventually evolve into the larger things. You get too comfortable over missing the big things and the rest is history.

This partially explains why almost everyone would return to their normal state of wealth over the following 5-10 years after the hard reset. Although everyone’s bank accounts were reset, the money habits, commitments, and practices of people didn’t change. Some will forever blow through paycheck while others will be meticulous in their savings. Some will forever pay attention to the small things that add up while others will gloss over the fine details. Much of it is rooted in the small things. They add up to the big things.

Small things matter. Recently, a door plug flew off a Boeing 737 MAX 9 aircraft while it was en route to Ontario, California from Portland, Oregon. The four bolts that were intended to secure the door plug were missing when the incident occurred. Somehow the plane passed safety tests despite not having any bolts to secure the door plug.

Now, a 737 MAX 9 can seat up to 220 people and is 138 feet long, roughly 42 meters, so it is safe to say those four bolts were minuscule parts of the plane. A bolt may be .1%, if that, of a plane's size but not having them could have easily resulted in lives lost. Lives could have been lost over four small bolts. If the small details are ignored, they can create a much larger mess like an emergency exit door flying off while almost 15,000 feet in the air.

Perhaps, this is a very rare incident. The aircraft had logged 510 total flight hours and 154 flights before the missing bolts caused an issue. So, for the sake of sanity, maybe we get operations to proceed as normal. Safety measures are satisfied and all four bolts are secured on the door plug. Thankfully, now no door will be flying off six minutes into our flight.

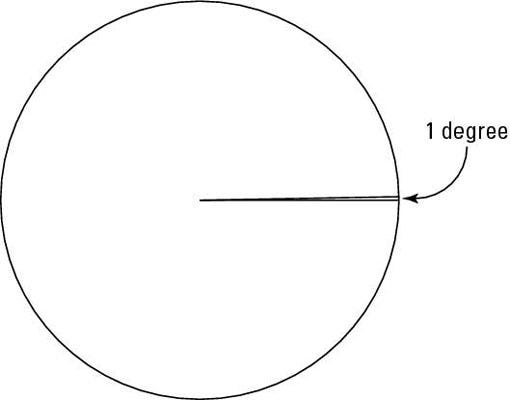

However, what if the bolts aren’t the issue but we are instead one-degree off course on our flight path. The pilot has made a miscalculation. Most would think this shouldn’t be a huge deal. One degree might land you on the far right or left of the runaway rather than in the center.

Except that couldn’t be farther from the truth. For every one-degree difference, you will end up one mile off course for every 60 miles of travel. To help give you an idea, JFK to LAX is roughly 2,450 miles. If you miscalculated by one degree coming from JFK to LAX, you would instead be 40.8 miles, the 2,450 miles divided by 60 miles, off course and land on California State Route 73 in Newport Beach, California. The small details matter. Safe to say you don’t want to try to land a larger passenger plane on a highway. In the grand scheme of things, one degree seems so small but if we miss the small stuff, it can just trickle down or snowball into large things. It doesn’t seem big at first but throughout any timeline, or 2,450 miles, the details matter.

There is the age-old example of buying a coffee a day is costing you an early retirement. It is the classic example of the small costs adding up. But let’s be real, a $6 coffee in the grand scheme of things is largely negligible. It is when these small things such as having seven streaming services, getting coffee every morning, going out to lunch with your coworkers every day, constantly upgrading your car or phone plan, and small, late night impulse purchases off Amazon compound that the real pain is felt. It is the lifestyle creeps where you slowly live a more luxurious lifestyle as your salary goes up. You get a raise but so does your lifestyle.

The small commitments and habits set the tone for the larger commitments. Eventually, you are so comfortable that you just comb over the large details on the home loan, the new car purchase, or whatever it may be. The small details lay the foundation.

Attention to detail is a large part of wealth building and it is why the rich people would be rich again. It is all about small shifts. People can become too infatuated by the idea of eliminating their daily coffee from their expenses yet they will buy a home at an insane interest rate that they can’t possibly afford. There is a degree to it that is more than hard work. You simply can’t just eliminate all the small, trivial things and hope everything will work out. You must not only work hard but you must work smart. Safe to say, working hard to lock in a better interest rate on a mortgage will be a lot more impactful than eliminating a $6 coffee. Prioritizing cutting costs on a mortgage’s interest rate is much smarter.

Hard work is necessary, and I know I have preached about it, but it is not the only thing.

Hard work alone won’t get you paid. A mover may be one of the most physically demanding jobs out there. You must work hard lugging heavy furniture because the furniture isn’t going to move itself. A couch can weigh 300 pounds and having to successfully navigate the large piece of mass through a dining room while not breaking any Fine China, not exactly easy. A sweaty endeavor in multiple ways. So why aren’t movers compensated to reflect being one of the hardest working professions? Shouldn’t their pay be more? Well, sometimes working smarter is greater than working harder.

The rich aren’t just lucky. Not only do they not gloss over the fine print, they understand what you work on and who you work with matters. Hard work is important but where you direct that hard work and with whom matters.

In Never Eat Alone, Keith Ferrazzi talks about how the rich always get richer,

“Before my eyes, I saw proof that success breeds success and indeed, the rich do get richer. Their web of friends and associates was the most potent club the people I caddied for had in their bags. Poverty, I realized, wasn’t only a lack of financial resources; it was isolation from the kind of people who could help you make more of yourself.”

Relationships matter. The individual who knows the right people for the right reasons can get very far. It is incredibly hard to achieve success, wealth, etc. alone. Relationships are a powerful mechanism and can be used to really leverage your work or wealth into blooming into something special. Initially, everyone might have $192,500 but you would best believe the rich would know people to help grow that amount rather quickly.

At the root of those relationships, and why they even exist in the first place, is the individuals do work that attracts others. Therein lies a body of proof of the person doing great work so naturally others want to be a part of it. It is about finding work that is play and work that can be sustained no matter if results don’t initially show. It is rooted in doing work you love. Doing what love and not chasing a paycheck is smart work not hard work. Anyone can be an investment banker and perhaps that is hard work but for most, it is not smart work. It is not something they love. The work must matter to the individual. Safe to say, if everyone had the same amount of money, there wouldn’t be too many investment bankers. The incentives wouldn’t be there. That is not how the wealthy would get back to being wealthy.

The wealthy don’t get back to being wealthy by being lucky. They notice the small details, they foster the relationships, and they place a huge emphasis on what they work on. A lot of this might seem trivial in the beginning but much of it can compound on each other.

The small things grow into large things. One connection can grow into a network of connections. A simple hobby of doing what you love can grow into a full-blown profession. The rich get richer because they tend to the small details and respect the small commitments. A simple dinner with a new friend? A huge emphasis is placed on it because you just never know where it might lead. I think it is safe to assume the $192,500 wouldn’t remain $192,500 for too long. Small things matter because they can accumulate.

Appreciate you reading.

-Scantron

A nation that forsakes its own while waging wars on the other side of the globe and stripping farms dry of water, unable to make up its mind between fiat and crypto. Yup makes sense.