Irrational Money

Trying to make sense when nothing makes sense.

Our relationship with money is irrational.

A $50,000 truck to drive five miles on a highway to work? Yes, please.

Wait four hours just to be the first in line at the new Buc-ee’s? Say less.

Much of this doesn’t make sense. Why spend $50,000 when you could pay $5,000 on a car that will accomplish the same thing? Why wait in a line for four hours when you can walk right in with no wait at the same time next week?

Our relationship with money can often be silly. Money is weird because it is like a bouncer at a bar. It tells us what we can and can’t do. It puts real limitations on what we can do in life. There are rules to follow, but the beauty of it all is not everything has to make sense to everyone.

We will always want more money no matter how much we have. I think of the work done by Harvard Professor Michael Norton in 2018. He determined that everyone believes they need 2-3x as much to be happy. Not exactly a light amount. It doesn’t make much sense. Naturally, we figure once we reach our desired income level, we will stop wanting more money. It is rarely the case. We constantly desire more. We could live a healthy life on $100,000 a year, cover all of our basic needs, travel to luxurious places, and do a lot more to enhance our quality of life while still saving a healthy amount, but that doesn’t stop the chase. I am not saying this is wrong either or I am above it. Instead, our behavior around money is rarely rational and probably, never will be. Just look at how our financial markets operate.

We have probably all heard the trope from John Maynard Keynes,

“The market can remain irrational longer than you can remain solvent.”

We see changes in stock prices of companies where they beat all of the key metrics in their latest quarterly earnings, but the stock still goes down. It happened just this past week with Costco. They beat all key metrics across the board on Thursday afternoon but on Friday, the stock closed down .67%. Not a huge move down, sure. However, one would reasonably expect it, to at the very least, be positive on the day after such a smashing success. At a high level, it seems rather unreasonable. Silly even. How does a company do so well yet the market penalizes them for their quarterly performance? In short, markets and money are irrational.

So many times, people say “Bad news is good news for the market” and vice versa. And to most, it makes zero sense. What does that even mean and how does that make any sense? It is a paradox. The markets are made up of different investors playing different games. Naturally, when someone is playing a different game than you, it looks irrational. We are all deeply rooted in our beliefs and play games by our rules, not others. We view everything through the lens of being the center of the universe. As David Foster Wallace says, in This is Water,

“Here is just one example of the total wrongness of something I tend to be automatically sure of: everything in my own immediate experience supports my deep belief that I am the absolute centre of the universe; the realest, most vivid and important person in existence.”

Sometimes, those games and what other people will do simply won’t make sense. We will never be able to rationalize everything and to think the markets will eventually become rational in your desired time frame is a dangerous game. The financial markets are incredibly hard to beat for a reason. It is the wisdom of the crowd, but the crowd is made up of human behavior and as we know, humans are incredibly hard to predict and sometimes, nutty. My shoe collection is a perfect example of that.

I counted. I have 38 pairs of shoes and another pair currently on the way, it’s wildly irrational.

I can’t fathom how people only have three to five pairs of shoes, it makes little sense to me and I probably make zero sense to them. If you asked me why I own 38 pairs there is probably no rational way to explain it other than, “I just love shoes. I see them as a key part of any outfit and we spend a lot of time on our feet.”

Do I need 38 pairs of shoes? Absolutely not.

I can’t quit them despite knowing that. It’s definitely a financial guilty pleasure of mine, but the beautiful thing about it is, it doesn’t have to make sense. I don’t break the bank to buy shoes and it is one of my irrational money behaviors.

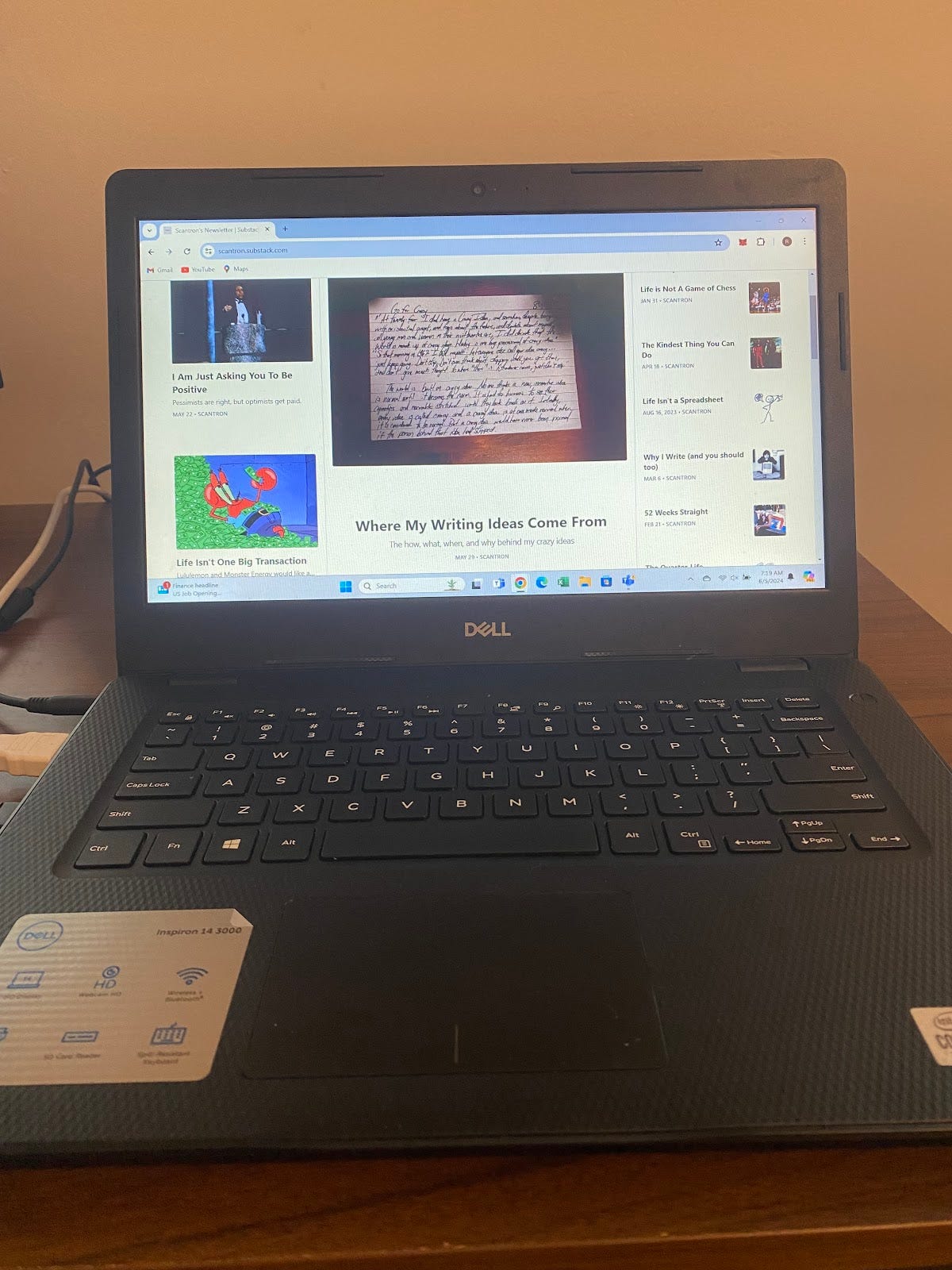

On the other side of it, I have a $350 personal laptop. I got the laptop as a one-year rental for my senior year of college. My first college laptop died a quick three-year death. I still have that $350 laptop today, squeezing life out of it four years later.

It has been on its deathbed a few times, but I can’t quit it. Investing in a sound, somewhat fancy laptop would undoubtedly be great for my writing, reading, trading, etc. but I refuse. I want to ride my laptop until it won’t turn on or combusts into thin air. Any budget, spreadsheet, or probably normal behavior would support the investment in a laptop.

It’s an investment in me. The laptop still runs fine and if I truly needed a new one, I absolutely would make that investment. Same for my shoes, I will occasionally toss some or give them away when I no longer use them. There’s a difference between being a little irrational and being ignorant. But I operate somewhat irrationally while not affecting my quality of life and those around me. I believe it’s a very normal thing to do.

I am irrational but also reasonable. I have accumulated shoes over the past eight years. I take very good care of them. My laptop probably works 98% of the time. I am not breaking the bank by buying shoes every week or struggling with a defective laptop. It is a little ridiculous but I own it. I am reasonable with my expectations and don’t disrupt my quality of life.

It is hard to explain why I need 38 pairs of shoes or why I use such a dinosaur-like laptop but it is all part of the human experience when money is involved. We don’t need a 6,000 lb., $50,000 truck to drive on a highway to work, to wait four hours in line when Buc-ee’s will be open at the same time next week, or to always make sense of how a company experiences a killer quarter but goes down in financial markets shortly after the announcement of the results.

Money and markets are irrational and sometimes, we don’t have answers. To try and rationalize everything with money and financial markets is one way to go mad. Instead, I have found the best way to make sense, when nothing makes sense, is to chalk it up to humans being a hard thing to predict because we all play different games and we all are the center of our own universe.

Appreciate you reading. Toss a like if you enjoyed.

-Scantron