Probable But Never Certain

On our never ending quest for certainty in an uncertain world and the meme stock mania.

I woke up today. Typically, this is never huge news. I hope it stays that way. There is a very, very high probability that I live to see another day as it currently stands when I lay my head down to rest, but of course, it is never certain. This is because we live in probabilities and not certainties.

Nothing is certain in life.

But we do have things that have a high probability. There is a very high probability that I will make it to work when I am supposed to be there, I go to the gym when my schedule calls for it, and I don’t skip dinner. There is a very, very high chance all of these things happen, but they are not 100% certain. Life is full of things, and certainties are not one.

When we view parts of life as being certain to happen, we get ourselves in trouble, especially when money is involved. The S&P 500 has yet to have a 20-year period without positive returns. Google, Apple, and Microsoft have yet to prove that they are bad investments, but we can’t be sure that it will always remain this way. Nothing is definite. Is there a very high probability that the S&P 500 will continue to be a good investment? I certainly think so. Can I be 100% sure of it? Absolutely not.

Certainty is a never-ending quest. We think we can reach it. Find any tweet on GameStop, GME, on Twitter, and the replies are littered with people declaring certainties. It is quite astounding.

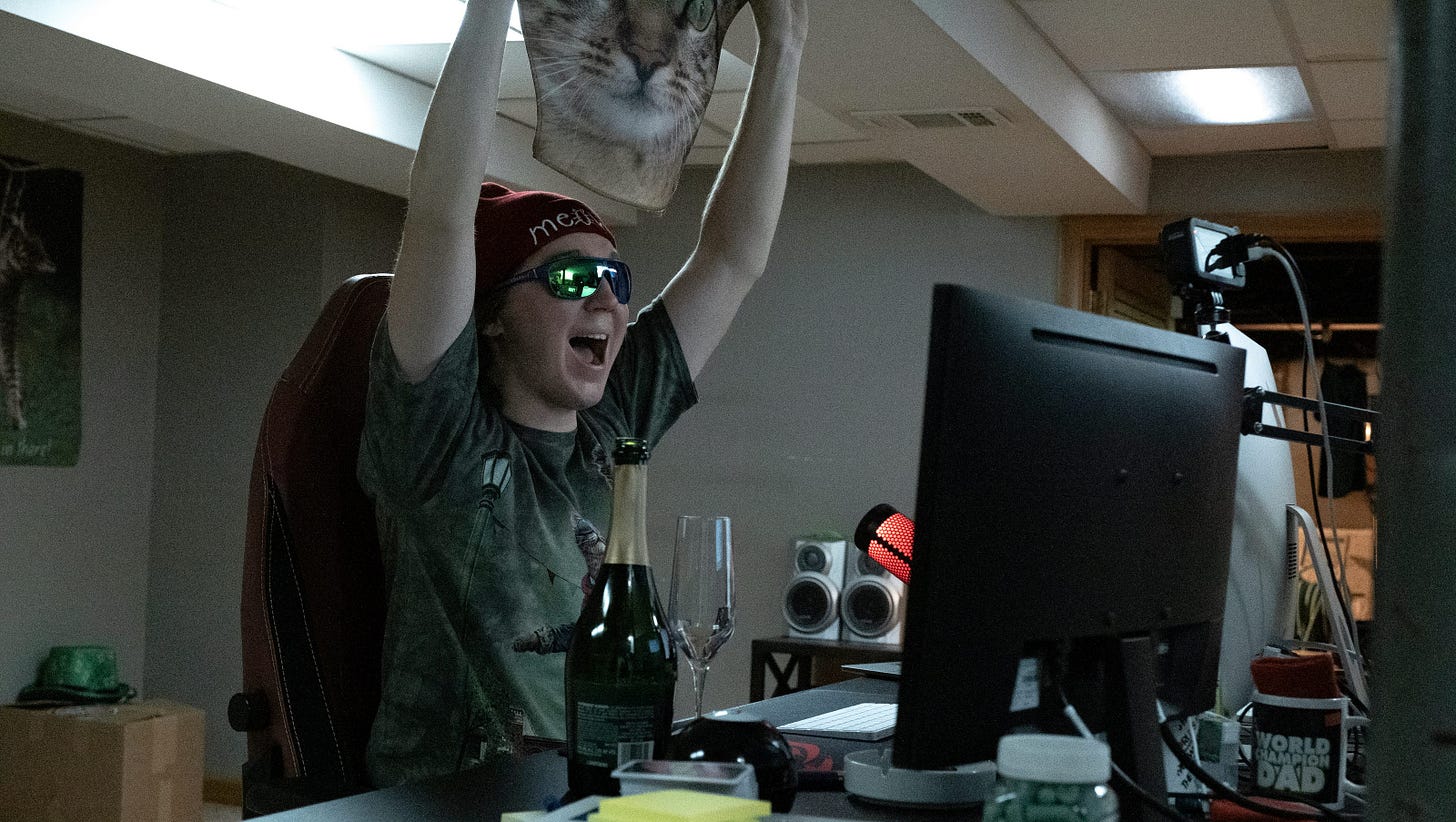

GameStop is affectionately a meme stock and has experienced extreme volatility as a result. Namely, thanks to Roaring Kitty. Roaring Kitty is the nickname of Keith Gill. He is a financial analyst and investor known for his posts on the subreddit r/wallstreetbets and sizable position in GameStop. He was a driving force behind the 2021 short squeeze and has since grown his GameStop position.

People are chomping at the bit to get involved with GameStop in hopes of catching the large upswing, similar to what we saw in 2021. FOMO is an influential force here, no one wants to miss out. Plenty of people have joined in hoping to make some quick cash. Some are certain of it, too.

Except, we can’t be certain of anything, and buying at any price does not guarantee a profit as some would like us to believe. The world is unpredictable and when we think we can predict the future, it is like putting on drunk glasses to try and navigate the markets. It can blind us from what we truly need to see. Inevitably, no matter how certain we are, we can’t account for everything. Something we don’t account for will surely surprise us.

GameStop was set to announce earnings after market close on June 11th, yesterday. There was a high probability it was going to happen on June 11th. Rarely, do we see companies move their earnings announcements. However, the company executives seeing a chance for GameStop to potentially be a real company and not just a meme stock, decided to announce their earnings early on the morning of June 7th with an increased share offering. Their earnings were not great and the stock reacted accordingly. I mean, outside of the meme stock mania, the company has been struggling a bit.

As part of the announcement and the previously mentioned increased share offering, they filed to sell an additional 75 million shares, which would help them make more money than they ever had before. And the stock would now potentially be diluted when those 75 million shares of stock become available in the market. The slice of the pie for the current investors just got a little smaller thanks to those shares.

It was truly a time for a quick profit for the company itself. A savvy move by management. There is no official statement on why GameStop decided to announce earnings early, but it did come before Roaring Kitty’s livestream. Potentially, they wanted to avoid the craziness and unpredictability of the stream. If you watch the video, you can see just by some of the words he says the stock moves in lockstep.

The livestream was going to affect the stock price, and instead of dealing with the volatility, management could cash in on the stock trading at elevated levels before the event was to occur. There was a decent chance this was the reason, but of course, we can’t be certain unless GameStop were to release a statement.

GameStop does have a legitimate business they are trying to run and they want to be more than a meme stock, but unfortunately, this hurts many people. The company announced the additional share offering before the stock market opened. People were left holding their shares. Nothing could be done with the market yet to open.

The stock closed at $46.60 last Thursday and as of the stock market close on Friday, sat at $28.22. A cool 40% drop in 24 hours. It dropped another 12% on Monday. Then went up 23% on Tuesday closing at $30.49, still below Thursday’s close.

People were certain with Roaring Kitty back on board, the stock was going to continue to drive higher, and they continued to purchase as the price went up. They were certain.

This is not to say that it won’t go higher in the future. I am not involved either way. Rather, it is to say that we live in an uncertain world that is based on probabilities and not certainties. We saw a very high probability that GameStop was going to announce earnings on Tuesday, a time that people might try to exit their position before, avoiding the volatility that can come with earnings. However, we couldn’t say for certain. Not to mention, many people didn’t have GameStop management doing an increased share offering on their bingo card.

It is when we live in certainties that we get hurt.

Ironically, while researching GameStop, I stumbled upon, “7 Once-In-a-Decade Buying Opportunities”. I was floored.

Just for me?

How was I so lucky to get seven, confirmed buying opportunities that only come once every ten years?

Except, if I have learned anything, it is too good to be true. Not to mention, if it was a once-in-a-decade chance, I don’t think it would be broadcast to the world or the most efficient market in the world would have already priced it in.

In finance, it is important to have a BS detector. Be wary of someone selling you certainties, seven opportunities that only come once in a decade, or a stock, such as GameStop, that is guaranteed to go up. Nothing in this world is a guarantee, mostly everything is sales, and we have a fixation with trying to forecast the future despite how hard it is. Morgan Housel, the author of The Psychology of Money, says,

“The inability to forecast the past has no impact on our desire to forecast the future. Certainty is so valuable that we’ll never give up the quest for it, and most people couldn’t get out of bed in the morning if they were honest about how uncertain the future is.”

And the beauty of it all is we don’t have to be absolutely certain of everything. We can be uncertain about the future and still be fine. You can be wrong just over half of the time and still win. Less certainties, more probabilities.

There is always the chance that something could go against us or we could completely gloss over the finer details. It is more about assigning probabilities to something and accounting for it never being 100%. As Voltaire said,

“Uncertainty is an uncomfortable position. But certainty is an absurd one.”

Appreciate you reading. If you enjoyed, please share or like!

-Scantron