The Dividends Life Provides

Memories are annuities and they pay out dividends the rest of your life.

It’s likely you are not going to be able to ski at 80. You can no longer do the season in Ibiza at 45. You won’t be able to stay on a friend's couch at 40. There are certain things in life you have to do now.

As time and health dwindle, you can’t do things you could once do. Those things you have to do when you are young are an investment in yourself. Things that your 80-year-old self may thank you for since you did them when you could.

We are all wealthy when we are young. Full of time and most likely, in great health. A time billionaire. Largely confined by nothing. We are nimble on our feet, our bones are strong, and our joints don’t need WD-40, the world is in fact our oyster. The possibilities are largely endless. Perhaps, the only thing truly constraining those possibilities is money.

As we slowly inch through life, we slowly lose things we can do. Safe to say, at age 40, if you couch surfed several weekends out of the summer, some may wonder if everything is okay. In most cases, when we start to creep past 35, kids start to enter the picture, a significant other who deserves all the love while becoming a top priority comes into the fray, and the list goes on. Time is not the luxury it once was. Responsibilities go up and the possibilities go down, this is not to say this is a bad thing, either. It is just a fact of life and a fact of growing up.

Time and health have an inverse relationship to our wealth. As we have less and less time and our health doesn’t afford us to do the same things we once could, monetarily, we are wealthier than ever. The hope is as you lose some of your health and time, you replace your losses with your wealth. The wealth and luxuries afforded as we age help to fill the void and holes left by less time and worse health.

This partly explains why it is best to chase certain experiences while you are young. Not only will it be hard to maintain that level of health and time will be less but it is a bet on yourself.

Stack Experiences When You’re Young

A bet that your future self will outearn your current self. A bet that you will continue to grow, improve, and prosper. A bet that the $300 flight you spent days deliberating if you could afford when it definitely wouldn’t place you in a bad financial position, largely won’t matter. It is just a minor inconvenience along the way. It is having faith in you and faith that you will continue to do great things in this world.

Despite spring break representing a very large part of my “having fun” fund in college, I used to sweat paying for spring break, every year. Yes, I worked hard over the academic breaks and during the school year to put myself in the best financial position possible when spring break rolled around, but I was also making a bet on my future self. A bet that, if an issue does arise, I will figure out the finances later. I wasn’t taking a loan out for this either. In the grand scheme of things, it was largely a trivial amount.

Perhaps, you want to chase an athletic endeavor. For me, it was CrossFit. Never will I be so agile, strong, and time-rich that I can just start something entirely new. Never would there be a better time to start, even though it may be a bit expensive for someone just starting their career. It is something that was best for me to start when I was young.

Like anything, there is a balance between FOMO and spending money. It is about not being confined to a spreadsheet and willing to take on more risk, within reason, than you would later in life. Taking advantage of opportunities you are only afforded now.

I of course figured the finances of those situations out and I am still here to tell the story but what I failed to realize is trips, moments, and experiences like these, spent with the people I loved, would pay me back in an intangible way. A way that enriches your life in which no tangible good could. It was not just a money pit.

The Dividend that Never Stops Paying Out

Some investors chase dividends, a sum of money paid regularly to shareholders. Some view it as an easy way to have passive income. Some buy stocks just to get their regular dividends. Have enough shares of stock with a regular dividend, and that can be a nice stream of income.

Life is largely no different.

Our trips, experiences, and moments pay us back regularly too. That time you heard Pepas play in a French Club while surrounded by your best friends? Yeah, I know what that feels like too. Or how about the time you went to Florida right before COVID shut down the country and you got one last week of freedom? Oh yeah, can’t forget that.

Humans are more nostalgic for the past. We like to live in it. There is a reason why Dad loves to tell you about the Blizzard of ‘78. Or your friend won’t shut up about the time they went to Red Rocks. It is all a part of the memory dividend paying out.

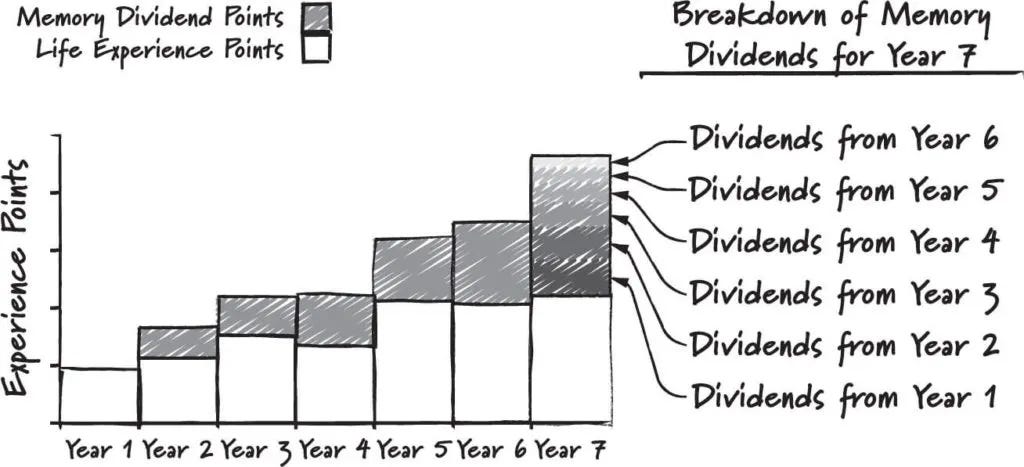

The memory dividend is best looked at through the lens of an annuity. The memory is the annuity and it pays out dividends the rest of your life. It provides continual gratification from your fondest memories.

The memory dividend allows for greater connections and stronger reflections on things we should, and sometimes have to, do when we are young. It is not only best to chase those experiences and moments when you are young due to time and health, but because like an annuity, the memories will just compound over time.

Those memories never die. The fire that keeps the flame ignited is the idea that we could once do those things but now, we can’t. It invokes nostalgia for things we went after when we were young. Things that maybe would just be goofy or irresponsible to do today. Safe to say, you probably shouldn’t try to trek 5 miles in a foot deep of snow when you are 60. Or get a party bus with 30 other people to Red Rocks when you are 70. Or start competitive CrossFit when you are 80.

The memory dividend is the repayment of the investment in yourself at a younger age. The return on a belief that your future self will outearn your current self. The risk you assumed and the costs you pay, will work itself out.

That investment doesn’t come without returns. It comes in returns of immediately igniting a conversation about your favorite artist you saw live at a music festival with a stranger who has done the same, it comes in returns of sharing fun college stories with your boss who has experienced similar, and it comes in returns of being able to connect at another level with those around you all while enjoying your life.

People view experiences and excursions as sunk costs. There largely isn’t a tangible souvenir, like say what buying a pair of shoes may provide. The money was paid before. The experiences are had. The return ends when the trip ends. However, if you stop and pause, you begin to realize those trips or experiences continue to pay out.

We always see the highest ROI on the things we did, not the things we didn’t do. Never do we regret action. We regret inaction and we may regret how things unfolded but largely, we never regret taking that leap.

In the Power of Regret by Dan Pink, a 47-year-old woman surveyed on regret in a study says,

“I regret not traveling more when I was younger—before I had a mortgage and child and “real job” and all the responsibilities of being an adult. Because now, I don’t feel like I have the freedom to do it.”

It is the pain of “What If?” The pain of not taking the leap and chasing what you truly want and wish to experience. The half-life of regret due to action is much shorter than the half-life of regret due to inaction. No one ever regretted spending a little extra for a nice pair of running shoes to chase their goal of finishing a marathon and then finishing said marathon. They regret never having tried to complete a marathon.

Action at least provides us with what happens next. Inaction only provides speculation of what could have been. The consequences of inaction slowly eat away at us, wondering what may have been on the other side.

It is hard to see how a bet on our future self will lead to more regret than if we had not bet on ourselves. It is important to chase certain things while we are young. Never should the appetite for risk be larger. The 20s are meant for figuring out where life may take us.

Parting Words

These years don’t come with zero returns either. Even if we fail or we may regret how it turned out, we will forever get returns through the memory dividend. Unlike dividends, the memory dividend isn’t confined to annually, quarterly, etc. it can be paid at any moment. Not to mention, it is inflation-proof. How much and how often it pays out is largely infinite too. Our best memories live with us forever and however much we pay to make it happen, often never comes close to the returns we may get. The revenue is so much greater than the expenses.

Dividends don’t have to be confined to your stock portfolio, annuity, or 401k. Life pays out dividends as well. Chase the memory dividends. Those compound at a rate faster than any retirement account ever could.

Thanks for reading.

Scantron’s Selections - A few things I loved this week.

Phil Heath - Modern Wisdom - A look into the mind of a guy who has won the Olympia seven times.

Sam Hinkie - Invest Like the Best - Biggest takeaway: The people around you matter.