The Power of Positive Asymmetry

I’ll have a ton of upside and very little downside, please

On March 15, 2019, the Miami Dolphins traded Ryan Tannehill and a sixth-round pick to the Tennessee Titans in exchange for a fourth-round selection in the 2020 draft and a seventh-round selection in the 2019 draft. After the trade, Tannehill would then sign a one-year deal with the Titans worth $7 million and the deal could be worth up to $12 million with incentives. This would make him the 23rd highest paid quarterback in the NFL for the 2019 season.

Tannehill was coming off an ACL tear in the 2017 season as well as missing six weeks in the 2018 season due to a shoulder injury. The Titans were betting on talent. He was the 8th overall pick in the 2012 draft, set franchise rookie records for the Dolphins, and led the Dolphins to the playoffs in 2016. He was traded for picks in the fourth and seventh round where often, those players get drafted but don’t make the team. An investment with very little to lose, two late-round draft picks, and much to gain, a potential franchise QB if his play can ever reach his talent level.

To give you an idea, Miami would go on to trade the fourth-round pick received in that trade to the Steelers and use the 2019 seventh-round pick on Chandler Cox, a fullback from Auburn. Chandler Cox would go on to have two receptions for nine receiving yards in his NFL career before being waived. He is now an Ortho Specialist at Applied Medical in Auburn, Alabama. Chandler, if you’re reading this, this is no dig on you, you made the NFL and played! Kudos! However, Tannehill was traded for pennies on the dollar. Not to mention, this trade was for the most important player on a football field, the quarterback.

Tannehill and Tennessee

In Week 6 of the 2019 season, Ryan Tannehill would replace Marcus Mariota and play well, well enough to earn the starting job in Week 7 and the rest, well the rest would become history. Tannehill would lead the Titans to the AFC Championship where they would lose to the eventual Super Bowl champion Kansas City Chiefs. He would make the Pro Bowl, be named Comeback Player of the Year, and be ranked in the Top 100 players of the season. Imagine if he had started the whole season, MVP might have been calling his name. He would then lead the Titans to back-to-back AFC South titles in the next two years. He did most of this on $7 million a year in the 2019 season. Some may say that was highway robbery for the Titans. One of the best QBs in the game for the 2019 season for two late-round picks.

The Titans should be celebrated here. The Titans made a move that involved risk but very little for that matter. What the Titans did was they embraced asymmetric risk. They took a risk on a player with an injured past but clearly, had talent.

Much to gain, little to lose

Positive asymmetry was happening. Positive asymmetry happens in situations where you have a great deal of upside and very little downside. It is a beautiful thing in life.

Yes, there are easily situations when times like this can fall flat on its face. The Titans were betting on a player drafted 8th overall who had the talent, but he did have a huge injury risk, coming off an ACL tear that caused him to miss a whole year as well a shoulder issue. However, the bet they were making was a small bet. NFL QBs can have contracts upwards of $30 million per year. They were paying 25% of that for one of the best QBs of the 2019 season.

Like the Titans, you must be willing to embrace risk. Positive asymmetry is a very powerful tool because you have much upside and little downside but with anything, there is no guarantee. Unfortunately, much of life isn’t guaranteed. Tannehill could have been terrible. He could have never rediscovered his form post-injury and not helped the Titans to the playoffs. The Titans would have been on the hook for $7 million. $7 million right down the drain.

However, let’s look at this in relative terms. $7 million in the NFL is a very small amount. Must be nice. The NFL salary cap, an agreement between teams and the NFL on what can be spent on player salaries, for the 2019 season was set at $188,200,000. A nice chunk of change. Only 3.72% of the Titans’ salary cap was going towards Tannehill, a meager amount. They had 3.72% of their salary to lose and everything to gain if Tannehill could even return to pre-injury form. Sounds like a fair trade to me.

Positive asymmetry doesn’t put a ceiling on what’s possible. The Titans probably would have never gotten to the AFC Championship had that not embraced it. It allowed them to play beyond their defined range in the preseason and create an unstoppable advantage, where they are only allocating 3.72% of their salary to one of the best players of the 2019 season. We must see the value in asymmetric risk and realize that the risk involved is usually minimal but the upside and growth we have to gain is huge.

What’s the worst that could happen?

Take reaching out to someone and letting them know you respect their work or complimenting a stranger in public. Two things can happen here. First, at the very worst you get no response or a quick “Thanks.” On the other side of that, could be a new friend, a new business partner, or just someone who is great to have in your network. You could face embarrassment for a few seconds before everyone proceeds on with their day or you could have unlocked a ton of new opportunities to help you grow, learn, and succeed. All because of something so small. It is clear we have positive asymmetry here. What we have to gain is so much more than what we have to lose and what we have to lose is truly not all that much. The beauty of positive asymmetry.

Asymmetric risk exists everywhere. Let’s look at Tesla. Tesla is an interesting company that almost didn’t make it. Crazy, I know considering where they are today. In 2018, Tesla almost reached the end when ramping up production for its Model 3 Sedan. During this time, the company was betting everything on this project and sought to produce 5,000 Model 3s a week in 2018. Tesla was also bleeding money at a very fast clip as other auto makers such as BMW were working to unveil their electric car models.

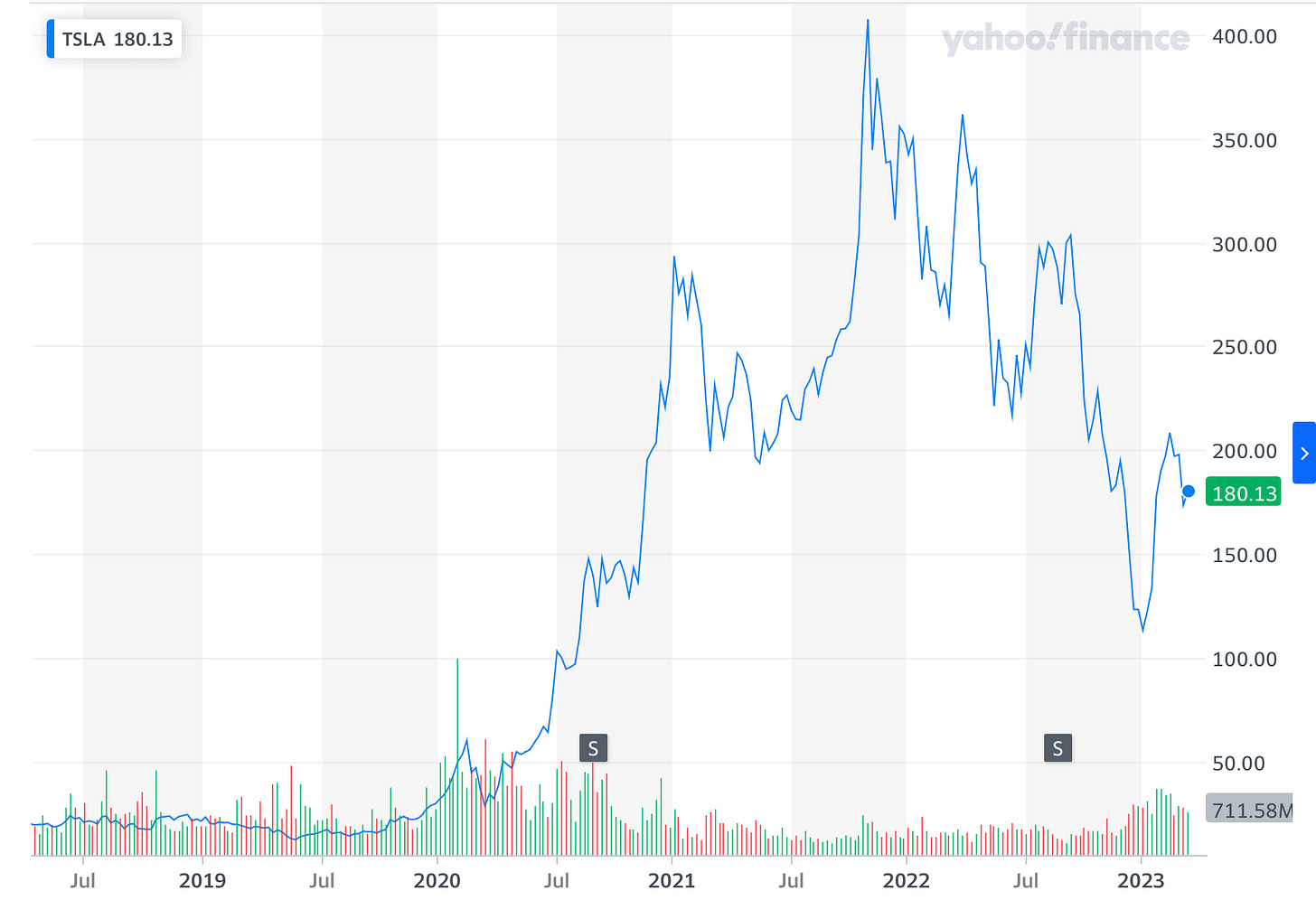

Fast forward five years, Tesla has the eighth largest market cap at $569.94B; ahead of the likes of Meta, Walmart, and Visa. Now, Tesla is to electric vehicles as Google is to search engines or Kleenex is to tissues. Synonymous. An impressive comeback from a company that looked to be on the ropes. In July of 2018, Tesla traded for around $20. Tesla would go on to trade up to $400 in the middle of 2021 and now, currently sits at $180.13 as of Friday’s close.

Now, this is not to say go and buy up Tesla’s stock. Rather, it shows the grossness of buy and hold but that is an article for another time. For venture capitalists and stockbrokers in 2018, Tesla could have been looked at as an investment with positive asymmetry. They were trading at $20 at the time but if Tesla could figure out the electric vehicle market this would be a situation with a lot more upside than downside.

The electric car market was largely untapped and the big auto makers were still trying to figure out the best routes to take here. Tesla was in the process of remaking a trillion-dollar industry. Yes, this is all easier to say when looking back. Tesla could have failed, the stock went to zero, and the company went bankrupt. Venture capitalists and stockbrokers would have lost their money on this investment. However, what proceeded the rough production stretch in 2018 would be a company that would at one-point 20x its stock price. This was an investment with a lot more upside than downside when it came down to it, an example of positive asymmetry. Yes, this is all easier to say when looking back but there is still much to learn from it.

Much of life is lived retrospectively. “I should have realized how good that investment was. Looking back there wasn’t much of a downside but a whole lot of upside.” The power of regret but also the power of positive asymmetry and asymmetric risk if you can notice. Positive asymmetry is everywhere in life, and we walk past it every day. There is a power in being able to notice those occurrences and then realizing what you have to gain is so much greater than what you have to lose. So, take a step back, look around, and see what the Titans did with Tannehill, or an investor saw with Tesla. Go find that positive asymmetry in life. Go compliment that person, start that blog, or cold email that person that you have always wanted to chat with because I am sure the upside is so much greater than the downside. I mean as we like to say, what is the worst that can really happen?