I probably should have started with this article but we all start somewhere and learn along the way. Why do I think this newsletter is worth anyone’s time? Why should one really care about options trading if they like sports betting, or even sports?

Well put simply, liquidity. Liquidity is king. It reigns all over life in areas we don’t even think of. Liquidity is your ability to get in and out of a position. If a lot of liquidity exists, you will easily be able to get out of your position without causing a change in the price. If very little liquidity exists, the price of the position will have to be sacrificed in order to exit the position. People are willing to deal with the illiquidity of sports betting markets so they should have no trouble with the liquidity in options markets. Perhaps, they should love it.

Liquidity builds on the concept of vig that was talked about earlier. If a sports betting market is liquid, the sides will deal -110 on each side, or less if they actually know how to book, and a perfect example of this is the NFL, or college football, side and total markets. Typically, we see this in larger markets where data and information is plentiful. In less liquid markets, we see -115 on each side or potentially -120, which would be more common in player props markets

A college football spread and total market is rather liquid as we see -110 being dealt on each side. However, as seen below, player prop markets are less liquid as less data and information is at play and more uncertainty can exist. In this case, we have Allen Robinson transitioning to a new team and that adds a dynamic of uncertainty on what his season could bring. It is important to consider the hold when betting into markets and the hold is directly affected by the vig. In this case, the hold is best described as the percent of each wagered dollar the sportsbook keeps in that market or on that bet. The hold for Allen Robinson’s player prop market is 5.88%, compared to the 4.55% of the Nebraska/Northwestern game, showcasing the market to be more illiquid as we see a $.28 spread, -126 and -102, rather than a $.20 spread, -110 and -110.

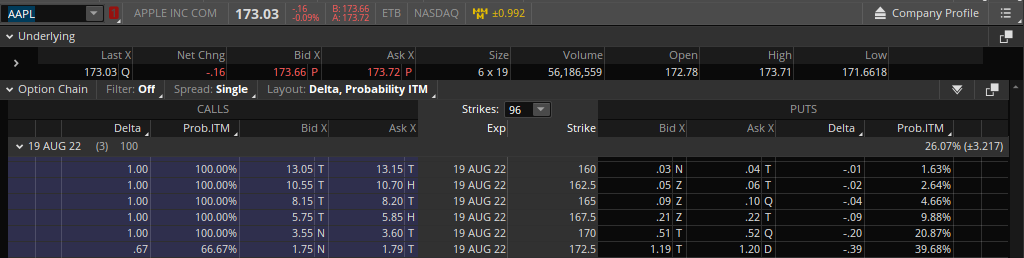

After seeing the hold and illiquidity of sports betting markets, you should have no problem with the liquidity seen in option markets. For the most liquid equities that trade in option markets, some have spreads as low as $.01. Say you want to do a trade on Apple (Ticker: AAPL), it is very common to see a bid of $1.19 and an ask of $1.20. The bid represents the buy side. So if you wanted to buy the option for $1.19 you would select the bid side and vice versa for the ask. The bid is the highest price a buyer is willing to pay and the ask is the lowest price the seller is willing to sell. The spread between the bid and ask, smartly known as the bid-ask spread, shows the liquidity in the market of the security.

When comparing the bid-ask spread to sports betting markets, the betting markets typically have spreads around the $.20 range as they require you to lay a $1.10 on either side to be able to win a $1. It is rather rare to see spreads lower than this, although some shops run promos or book with an $.16, -108 on both sides, spread. As can be seen, the strong liquidity that exists in the stock market is not necessarily seen in sports betting markets as well. Oftentimes, people don’t even understand the liquidity of the markets they are betting into. To break even on a series of bets where each side is being dealt at -110 you have to hit 52.38% of your bets, a result of the “vig” or “tax” seen so the sportsbooks can have an inherent edge. Or in the case of the Allen Robinson receiving prop, the break-even percentage rises due to the increased hold.

Sports betting continues to grow and as time goes by the liquidity has gotten better. However, it still has a ways to go before it can compete with the options trading market. The beauty of the most efficient market in the world, the stock market, is the liquidity it allows. If you don’t mind the illiquidity of the sports betting markets, take a stroll on over to the options trading markets and see what real liquidity is all about.