You Don't Need to Own a House

Interrogate what society lays out as “successful”

You don’t need to own a house. I know it's crazy, right?

Well, let me explain.

In 2013, Robert Shiller, an American economist and professor at Yale, won a Nobel Peace Prize in Economic Sciences. His work centered on understanding and explaining the dynamics of asset prices, especially in financial markets. He is most notably famous for his work on the housing market and early warnings about the housing bubble that led to the Great Financial Crisis of 2008.

His work of course includes a ton of interesting findings but one in particular stands out. It debunks much of what we are told. Between 1890 and 1990, the actual rate of return, when adjusted for inflation, of owning a home was been virtually non-existent. Owning a home was not necessarily a worthwhile investment. An idea that violates everything that we are told.

An idea that is hard to fathom because the majority of our young adult lives, we are led to believe that buying a home is an investment that will always appreciate over time. Homeownership is the tangible sign of having seized the American dream. To not own a home is to leave free money on the table. Have we ever stopped and thought, well how is that true? Are homes really no different than stocks?

Houses are an infinite money glitch. Buy a house anywhere and it will go up, an easy way to change your life and an easy way to get rich but stop and think about that for a minute. It is hard to believe that homes will rise a material amount every year because if they did, in the long run, no one would be able to afford a home. If houses went up 5-10% each year, plenty of people would quickly get priced out of the housing market. However, no one ever tells you this.

About a year into my career, I was having a conversation with a group of people about home ownership. One of the people had recently bought a home and was talking about all the costs associated with it and the necessary work that needed to be done to the house. The conversation resembled that of a pinball machine where the conversation just bounced between each person discussing their living situations, long-term plans, and hopes to one day get a house.

I described my situation and that I lived with a few friends on an extremely economical deal and had no desire to buy a house as I didn’t know if the city was a long-term location for me, financially I had other priorities, and I truly had no desire to own a house at the time, among other things. I was an anomaly. People felt like there was a time and place for renting but to not actively be working towards owning a home was stupid because money was just being left on the table. In the eyes of many, it is an investment that can’t lose and I was making a mistake.

However, houses shouldn’t be bought just to pump money out of them. There are reasons to own like wanting a place for just you and your family, needing a long-term location to settle down, not wanting to deal with a property management company or landlord, and the list goes on. To want to pump money out of a home is to go against the history of the American economy. An economy that largely just repeats itself over time.

It is proven over a sustained period, 100 years that is, that houses aren’t a means of generating a return. They depreciate, they have unexpected costs that will arise, and new and improved ones get built all the time, this part in particular because anecdotally it seems like they never stop building, RIP the environment. It is no different than a car. It is not easy to make money off owning a home. Sure, there are periods in time, such as the mid-2000s and a few years post-2008, where we see positive returns for homeowners but trying to predict those times is nearly impossible. Not to be remiss, we did just see one of the most insane housing markets ever when the world started to open up post-COVID since interest rates were so low. Houses sold for well over their asking price thanks to the cost of financing them being almost free.

Now, however, with interest rates being hiked over the past year and rates continuing to remain sticky without any cuts, mortgage rates are high. With high mortgage rates, we have increased borrowing costs for homebuyers. Increased home costs lead to less demand, less demand leads to lower prices, and we know the rest of the story. It is Economics 101.

Even in some places, like Austin, Texas, we saw rent prices drop year over year but based on what we are always told it would seem that never actually happens. Owning a house is always the way to go. It is an invisible script of success of our society and it is general advice that is not necessarily one size fits all.

Nationwide, the typical home mortgage payment costs 25% more to own than rent. Only 4 of the most populous U.S. metros have a homebuyer’s median monthly mortgage cost cheaper than the median monthly rent. Additionally, the median U.S. asking rent in October remained largely unchanged for the seventh straight month, a good sign for renters and not landlords. The rental market has cooled after previously being at all-time highs. The added benefit of rent too is it is the maximum you’ll pay while the mortgage is the minimum. Rising insurance costs and unexpected hiccups, there are a lot of things at play that can raise the monthly cost of a home. It is not always happy times like we saw for the housing market in 2021.

A lot of these landlords bought these houses with the idea of them being investment properties. Low interest rates and high demand paved the way, but now with rental vacancy rates the highest since 2021 the idea of a house always being a great investment is clouded. There are a lot of factors at play here and if recency bias is a thing, 2021 led us astray and the housing market won’t always be so wonderful.

To say someone needs to own a home as it represents the pinnacle of success and the pinnacle of the American dream is wrong. It is a case-by-case basis where objectively, history has supported it not being a great investment over extended periods, outside of a few select periods. Subjectively, however, it is dependent on the individual; each person has their own situation, feelings, needs, etc.

Owning a home is a mark of success our society has laid forth but each person is different on what success is to them. To say everyone must own a home is to group a country built on diversity into one bucket, something that surely won’t work. Success for everyone is different. People don’t gravitate towards advice threads on Twitter because that is largely blanket advice and futile. What truly grips them is reflections and notes from your life and work because advice doesn’t apply to everyone. From those reflections and notes, they can take bits of advice that may apply to them.

In America, we have invisible scripts of success like buying a home, everyone needing to go to college, and retiring at 65, just to name a few. We are led to believe we should just float down the river of life that someone else charted for us. We believe that success is already outlined and it is a one-size-fits-all bucket. It is a belief that is so deeply ingrained in our society that no one questions it.

Imagine if we did this with sports. We judged the player picked last in the draft the same as the player picked first. We grouped success in a one size fit all bucket but we all know that would be an ineffective method. There are different expectations. Success is different for every player, it is relative to them. To judge the first pick in the draft in the same way as the last pick in the draft would be illogical.

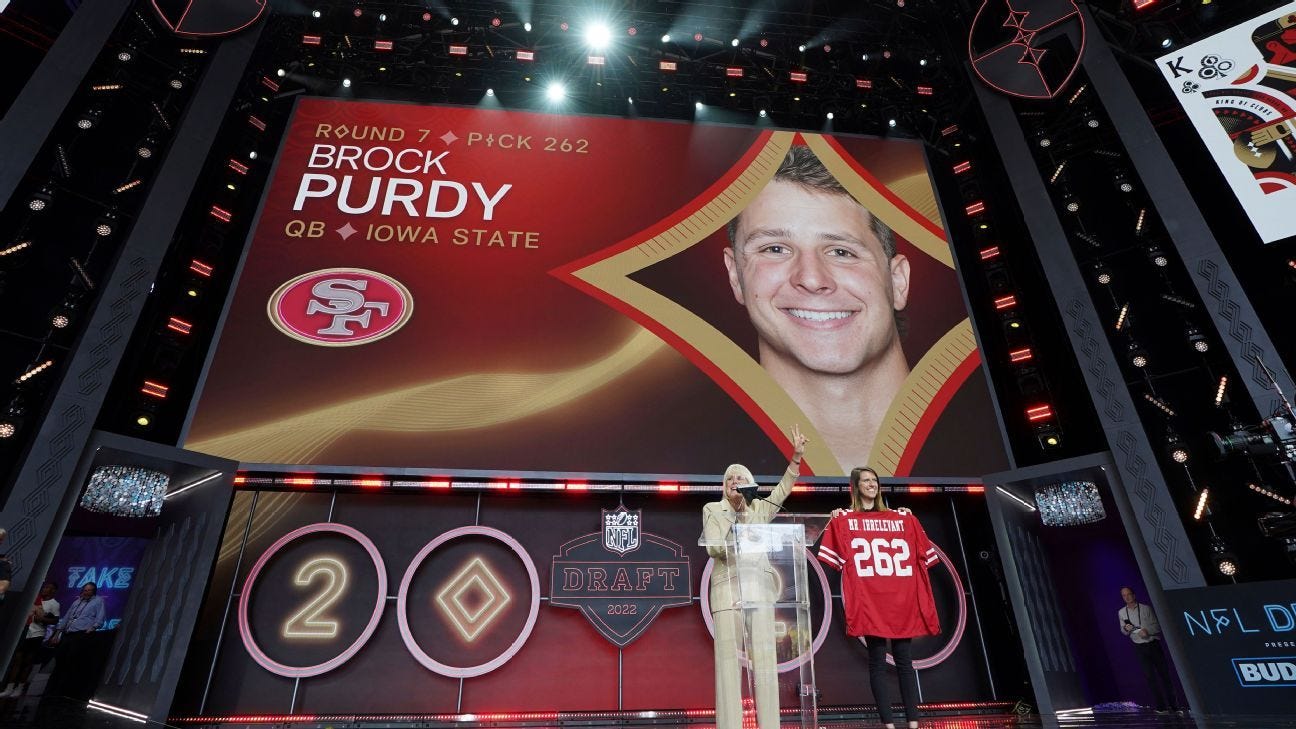

In the 2022 NFL draft, current San Francisco 49ers QB Brock Purdy was taken last in the draft, Mr. Irrelevant as they call it. Let’s take a moment and realize success for Mr. Irrelevant might just be playing in one NFL game. They are given a nickname with “irrelevant” in it, so safe to say not too much, if anything, is expected of them. Purdy has far exceeded any expectations passing for almost 4,000 yards and having 28 TDs to 9 INTs across his two seasons. A smashing success.

On the flip of that is Travon Walker, the first pick of the 2022 NFL draft. He has had a decent start to his career but some may say he is a slight bust or not worth the first pick when you see Aidan Hutchinson and Sauce Gardner drafted right behind him, two very good players the Jaguars could have drafted instead of him. We would never group and define the success of the first and last pick in the NFL draft in the same manner but we love to do it in our lives. Owning a home is a glaring example.

Each person has a different way of defining success. Some may view it as more work-life balance, some may say more money, some may think more time with family and friends, and some may say a home on five acres of land. It is different for everyone. It is wrong to say everyone must own a home and everyone should do everything in their power to make it happen. Subjectively it could work for some people and subjectively it could not. Not to mention, objectively it is a lie that we are spoon-fed. Home prices don’t always appreciate and aren’t always a great investment. It is an incorrect belief that we have just accepted as normal.

I can sleep well at night knowing I continue to live with five of my best friends and don’t have to worry about my water heater breaking, trying to get a new roof, or even cutting my grass. Right now, this is a success for me. Not to mention, I don’t have to stress about making such a large investment. I don’t stress because it hasn’t always been a great investment. It is not like dollar cost averaging the S&P over 30-years.

I undoubtedly believe one day, owning a home will be a sign of success for me. Success is relative and success is different for everyone. Success always changes as we grow. Interrogate what society lays out as “successful”. I did and I have never felt better about not owning a home.

Appreciate you reading.

-Scantron

Scantron’s Selections - A few things I loved this week

People always want more money and a higher income. A WSJ article breaks down just how much that is. How much more money would you need to be happy?

The Rock made a podcast experience and I always enjoy hearing his reflections and thoughts. A man who truly has seemed to do a little bit of everything in life.

A Fred Again set that I can’t get enough of. Probably have watched it at least 20 times over the past week.

Thanksgiving. Happy Thanksgiving to all those who celebrate.